Top 10 Sugar-Exporter Countries: Analyzing Global Sugar Trade with Import-Export Data

02 Mar 2025

Sugar is a significant agricultural commodity that is very important not only in the worldwide economy but also in the global commerce and agricultural industry. Most of the time, the main sources of sugar are sugar cane and sugar beets with the production being mostly done in areas with good climate and advanced farming techniques. The sector is formed by fluctuating supply-demand dynamics, government policies, and technological advancements.

The main stakeholders in the sugar trade are some of the biggest producers like e.g. Brazil, India, and Thailand successively; they account for a major part of the world's global sugar supply. At the same time, however, some of the demand is also motivated by such causes as climate change, ethanol production, and changing consumer preferences. The countries that manage to have high sugar consumption patterns, for example, India, China, and the United States are the ones with the most influences on international trade.

Nevertheless, the global sugar prices are determined by production costs, climatic factors like weather disruptions, and export policies as they change yearly. The growth in industry leads to the fact that the firms must look for accurate trade data so that they can react well to the market fluctuations and be able to mature their strategies in sugar imports and exports.

Global Sugar Production Overview

Global sugar production had reached 182 million metric tons (MMT) by 2024 because of which sugarcane accounted for 80% of the output, and sugar beets made up the other 20%. The primary sugar-producing countries namely Brazil, India, and Thailand control the global supply chain that guarantees an uninterrupted supply of sugar for a steady demand within the country and worldwide trade. While some countries mostly cater to domestic sugar consumption, others such as Brazil and Thailand mainly focus on exports. Numerous factors, for instance, the suitability of climate, technological advancements, and government programs, continue to be the main drivers of the industry, thus imposing themselves on the production level and the global sugar trade dynamics.

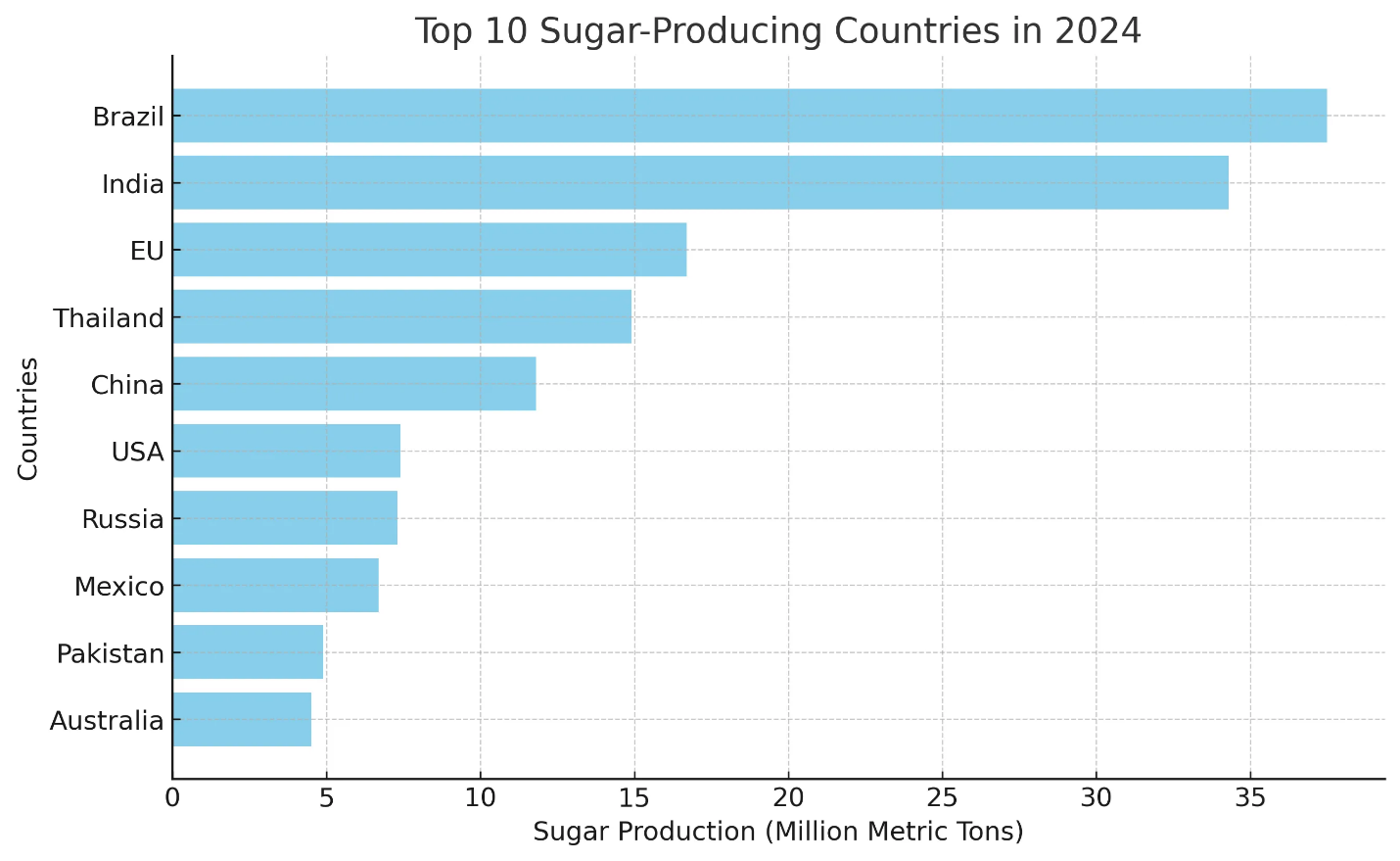

Top 10 Sugar-Producing Countries in 2024

| Rank | Country | Sugar Production (MMT) | Share of Global Production (%) |

|---|---|---|---|

| 1 | Brazil | 37.5 | 20.6% |

| 2 | India | 34.3 | 18.9% |

| 3 | EU (France, Germany, etc.) | 16.7 | 9.2% |

| 4 | China | 11.8 | 6.5% |

| 5 | Thailand | 14.9 | 8.2% |

| 6 | United States | 7.4 | 4.1% |

| 7 | Pakistan | 4.9 | 2.7% |

| 8 | Russia | 7.3 | 4.0% |

| 09 | Mexico | 6.7 | 3.7% |

| 10 | Australia | 4.5 | 2.5% |

Key Highlights from the Top Producers:

- Brazil remains the largest sugar Exporter, contributing over 20% of the world's supply and exporting nearly 25 MMT annually.

- India follows closely, with its sugar industry heavily dependent on domestic demand and government subsidies.

- The European Union focuses on sugar beet production, with France and Germany leading the charge.

- China remains a major importer of sugar due to its high domestic demand.

- Thailand and Australia are key exporters, supplying large markets in Asia and the Middle East.

Which Countries Consume the Most Sugar?

The global sugar consumption rate is projected at 177 MMT in 2024, with demand rising across multiple regions. The top sugar-consuming countries include:

- India – 29 MMT

- China – 16.5 MMT

- European Union – 15.2 MMT

- Brazil – 11.8 MMT

- United States – 10.5 MMT

Notably, while India and China are top producers, they also consume a significant portion of their output, requiring imports to stabilize their markets.

Top Sugar-Exporter Countries in 2024

| Rank | Country | Export Volume (MMT) | Major Buyers |

|---|---|---|---|

| 1 | Brazil | 25.0 | China, India, Indonesia |

| 2 | Thailand | 10.2 | South Korea, Malaysia |

| 3 | India | 6.8 | UAE, Bangladesh, Sri Lanka |

| 4 | Australia | 3.5 | Japan, South Korea |

| 5 | Mexico | 1.9 | United States |

Sugar Trade and Export Trends Over the Last Decade

- Global sugar export data have grown by 3.5% annually, with Brazil maintaining its top exporter position.

- India's export policies fluctuate due to domestic demand, affecting global sugar supply chains.

- Thailand and Australia continue to expand their market reach, focusing on high-quality sugar exports.

Sugar Pricing Trends in 2024

The global sugar market is the product of production costs, consumer tastes, and climate conditions. At present, sugar prices are still unpredictable as they have multiple factors such as disruptions in the supply chain, natural disasters, and government policies related to exportation that can create waves in the market. The big producers such as Brazil, India, and Thailand are the focal points of the world trade, with the number of exports being dependent on the domestic demand and government subsidies. By availing of data from the Cypher Exim company, which is engaged in the collection of import-export Data, the business will be in a better position to make accurate decisions. The buyer-supplier relationship can be improved, and the market trends can be predicted, thus businesses can make sound decisions in sugar procurement, exports, and global trade strategies for businesses worldwide.

| Year | Average Sugar Price (USD per Metric Ton) |

|---|---|

| 2020 | $310 |

| 2021 | $370 |

| 2022 | $450 |

| 2023 | $510 |

| 2024 | $490 (Projected) |

- Prices peaked in 2023 due to extreme weather conditions in key producing regions.

- Subsidies in India and export restrictions in Thailand have impacted global prices.

Production Costs Across Major Sugar Producers

Production costs vary due to labor, land, and input costs. Some key insights include:

- Brazil: $300 per ton (lowest due to large-scale production)

- India: $450 per ton (higher due to labor and subsidies)

- Thailand: $420 per ton (competitive pricing)

Global Sugar Market Forecast for 2025

Looking ahead to 2025, key predictions include:

- Sugar demand expected to rise by 2.8%, driven by Asia and Africa.

- Increased production in Brazil and Thailand to balance the growing global demand.

- Higher focus on ethanol production, impacting sugar supply for exports.

Cypher Exim: Your Partner in Global Sugar Trade

At Cypher Exim, we specialize in import export data solutions for the sugar industry. Whether you’re looking for reliable buyer-supplier information, market insights, or trade analytics, Cypher Exim provides real-time data to help businesses make informed decisions.

Also may Read : El Salvador Largest Trading Partners & Key Trade Insights

How Cypher Exim Can Help:

✅ Access verified exim data on sugar trade.

✅ Identify potential buyers and suppliers in global markets.

✅ Analyze trade trends, pricing, and market forecasts with real-time insights.

📊 Get the latest sugar trade data with Cypher Exim and stay ahead in the market!